RMH Market Watch – Ghost of Halloween

- rmhwebsite

- Oct 13, 2022

- 6 min read

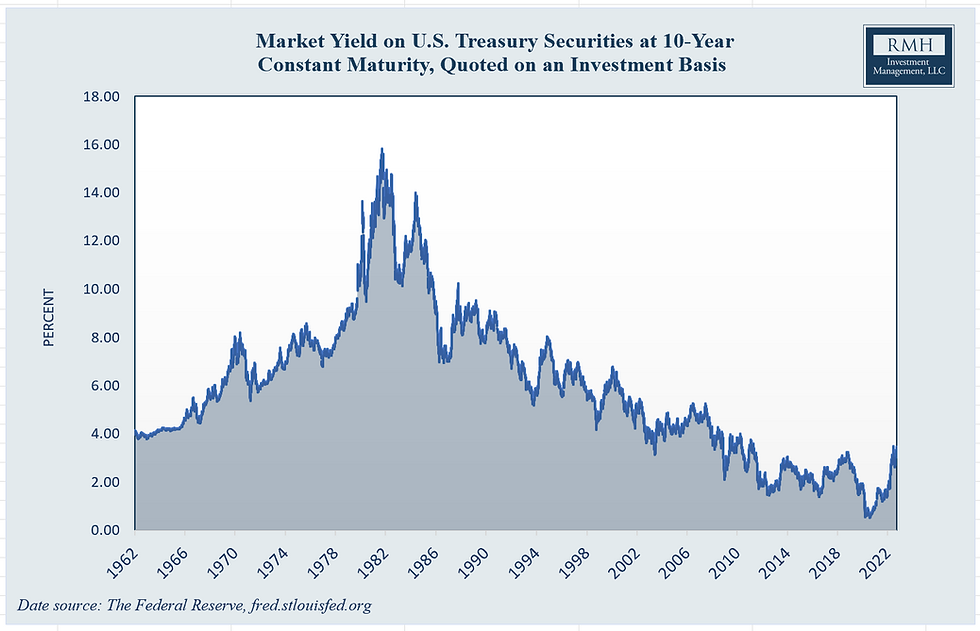

Well, the end of the month is Halloween and I wonder if any of the current Federal Reserve employees, including the voting governors, will be wearing an Arthur Burns ghost costume this year? I am thinking not, as they don’t want to be associated with the Governor who could not control inflation under his watch, and which led to the Paul Volcker term, where interest rates on US Treasuries went to 15%, to fight inflation and the economy went into recession.

From the US Federal Reserve website, the following commentary on Arthur Burns is most illuminating (the underlining is mine for emphasis):

Burns assumed leadership of the Federal Reserve during the middle of what would later become known as the Great Inflation (1965–82). In short, easy monetary policy during this period helped spur a surge in inflation and inflation expectations. When inflation began to rise, policymakers (in retrospect) responded too slowly, leading to a recession. Inflation was exacerbated by several adverse economic factors during the decade: the administration’s wage-price control program that artificially held down inflation, oil and food price shocks, and government fiscal policies that stretched economic capacities. As Burns later reflected, “In a rapidly changing world the opportunities for making mistakes are legion.”

Instead of the Energy shock of 1973 which came about from the surprise attack of Egypt and Syria (with the support of the rest of the Arab world) on Israel, and their resulting decision to triple energy prices overnight as the US was supporting Israel…just substitute Covid and its attendant problems. The playbook was already written on what to do to avoid runaway inflation when we had both Monetary and Fiscal stimulus at the same time to help lessen the effects of Covid, not only in the US, but in the rest of the world as well.

The following quote is most likely due to writer and philosopher George Santayana, and in its original form it read, “Those who cannot remember the past are condemned to repeat it.” While researching this quote, I kept seeing Winston Churchill’s name being ascribed to a very similar statement. Here is his quote from the British House of Commons:

“When the situation was manageable it was neglected, and now that it is thoroughly out of hand, we apply too late the remedies which then might have effected a cure. There is nothing new in the story. It is as old as the sibylline books. It falls into that long, dismal catalogue of the fruitlessness of experience and the confirmed unteachability of mankind. Want of foresight, unwillingness to act when action would be simple and effective, lack of clear thinking, confusion of counsel until the emergency comes, until self-preservation strikes its jarring gong–these are the features which constitute the endless repetition of history (see sources).”

A number of months ago I thought we could have a soft landing (no recession), we had strong earnings from the S&P 500 companies, strong employment (96.5% of the working population employed), and wage growth. Now I am not so sure.

What we didn’t have were supply chain issues figured out. For example, this was easily confirmed by new cars/trucks lying dormant for lack of semiconductor chips, the cost of shipping containers was at all-time highs, China in an almost permanent lockdown due to Covid. Now we have more supply chains being moved to the Americas (US/Canada/Mexico), out of China where possible in the short term, and long term all feasible options are being examined. To me, input costs as part of the inflation calculation are coming down.

We have interest rates going up in dramatic fashion both short term and long term. This affects the real estate industry which is responsible for around 25% of GDP. Higher interest rates in the short term will cause this industry to contract

The interesting thing about this chart in my opinion are two things:

The steepness of the rebound in interest rates in 2022, probably causing 20% losses in longer dated US Treasury Bonds (USTB).

What happens if the steep rise in USTB yields was a partial result of foreign governments selling their USTB holdings? Quite often they sell USTB to buy their own currency thereby strengthening it. If this was the case, then one of the buyers of USTB debt no longer exists. They will not be buyers until the US currency starts to weaken.

From Lynn Allen Schwartz writing on Seeking Alpha her article titled “Energy vs. Sovereign Bonds”:

Foreign central banks accumulate Treasuries and other reserve assets when times are good. In other words, when their economies are growing, and when the dollar is weakening vs. other currencies, they have flexibility to print currency and buy foreign assets. This is like a squirrel collecting nuts during times of abundance.

And then, during periods of recession, or when the dollar is sharply strengthening and their own currencies are weakening, these foreign central banks can sell some of their reserves and buy back their own currency, strengthening it. This is like a squirrel eating the nuts during the winter that it has previously collected.

Central banks buy or sell reserves assets in a counter-cyclical way to manage the volatility of their currency relative to the dollar. This chart shows the dollar index vs. the portion of foreign-held Treasuries in custody with the Fed:

Looking at the broader picture of over $7.5 trillion in Treasuries held by foreign sources of which this Fed custody snapshot represents about half, the amount has also been flat-to-down over the past year despite an increase in the amount of Treasuries outstanding. Foreign official sources (e.g. central banks) have been net sellers, while foreign private sources have been mild net buyers, with the overall amount being slightly down.

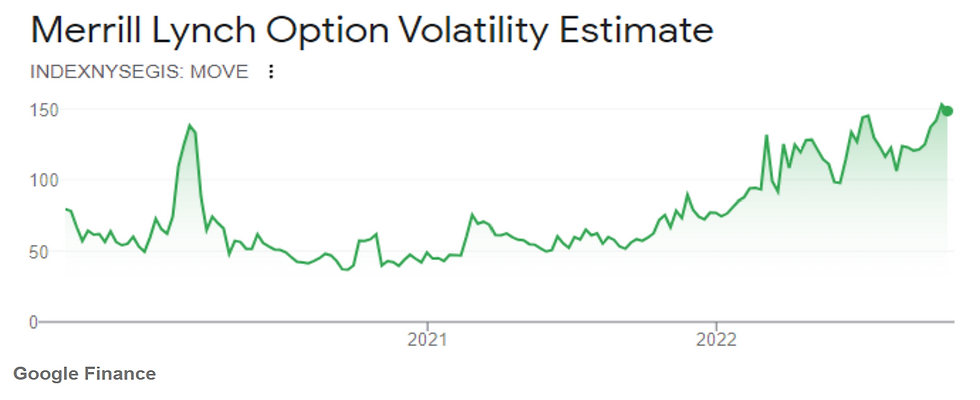

As a result, US Treasury market liquidity is very poor, and volatility is very high.

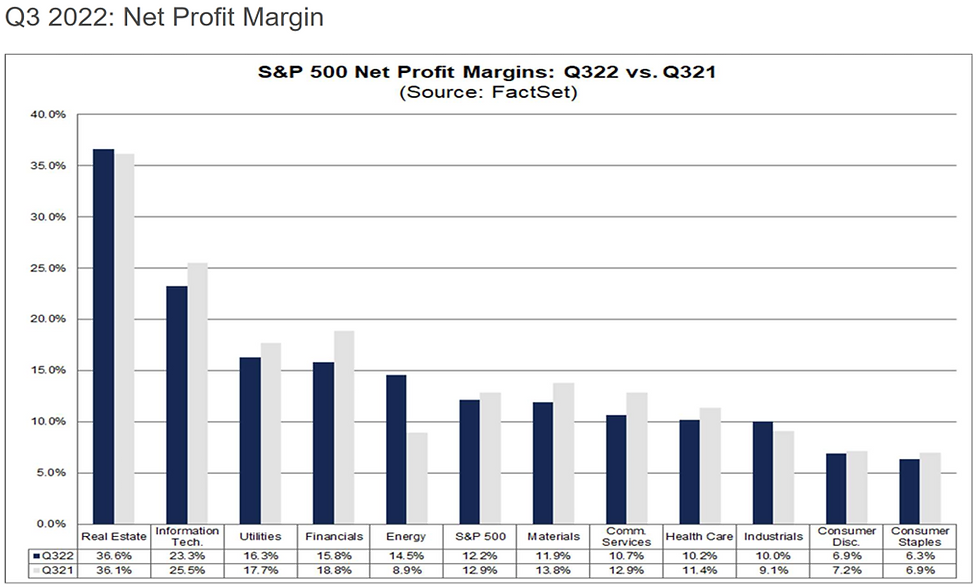

September 30, 2022 has come and gone which means earnings season. Below is a chart from Factset showing profit margins. All of the industries making up the S&P 500 are positive, however they will have negative earnings growth (earnings will still be positive, but the growth rates will be negative). To me, as I have said it before, it is hard to have a meaningful recession when all of the companies are making profits.

Finally, what could go wrong that is out of the Fed’s control:

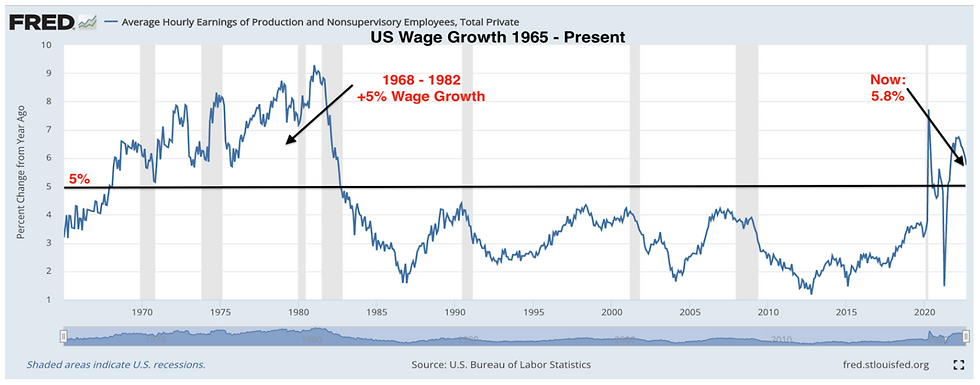

1) Wages, showing 5%+ growth this year, generally speaking not a good figure

It has come down modestly from its January - March highs of near 7 percent. The chart above, however, clearly shows that only recessions (gray bars) meaningfully reduce annual wage growth. WE are starting to see announced layoffs, however the big problem is that there is still in excess of 1.25 jobs for every person that is looking.

2) Energy, completely out of the Fed’s control. We have energy prices that have come down from substantial highs. In the short term this will lower inflation, the problem is in the future when energy prices start rising.

a. The strategic petroleum reserve needs to be refilled, in our opinion not sure it was needed, however this is an election year…

b. China getting back to work as Covid lockdowns will shortly end, therefore energy consumption will be up dramatically worldwide as a result. Globally, no surplus anywhere.

c. However with the lack of reinvestment in the energy industries, we are doomed to have shortfalls worldwide for the foreseeable future, prices will be going up. Both the Ukraine situation, and the actions of OPEC+ will contribute to a new higher floor for both oil and natural gas. Domestic energy policies around the world have not helped as well.

As always we live in interesting times, and it is a joy for us to try and understand what is happening here in the US and around the world as it affects investments.

If there are ever any topics you wish for us to explore, please let us know. We are here to help and guide you through these times.

We thank you all for taking the time and reading “Market Watch.” It is meant as an educational piece on the always evolving markets. It is something we plan on providing every month, and your feedback is very important to us.

On a personal note, RMH is now in the position to bring on new clients so please be sure to share this informational letter with whomever you wish. RMH’s focus is on the customizable investment needs of individuals, families, and foundations. We enjoy working with our clients to better understand their goals, values, and passions for what is important in their lives. In expanding our client base, we look forward to working with people who share these same desires

Richard Mundinger, CFA

Ashlyn Tucker

Sources:

House of Commons, 2 May 1935, after the Stresa Conference, in which Britain, France and Italy agreed—futilely—to maintain the independence of Austria.

Lynn Alden Schwartz; https://seekingalpha.com/article/4545647-energy-vs-sovereign-bonds

コメント