RMH Thoughts: Energy (Commodity Metals) & Inflation - Part II

- Richard Mundinger, CFA

- Aug 1, 2022

- 5 min read

Updated: Oct 8, 2022

Part II: Energy and Inflation

Energy, Food and Inflation all are intertwined. As this is a complicated topic, this is the second of two articles. As they say, a picture is worth a thousand words. Quite simply, the Federal Reserve (Fed) as we have mentioned has two remits:

Full Employment, where are currently sit, at 2 open jobs for every person wanting a job.

Control Inflation, which as we write this article suggests they are behind the curve trying to slow it down.

I have been reading the economist for at least 40 years, and KAL’s cartoon usually hit the nail right on the head. Quite simply, the Fed will do whatever it takes to drive inflation down at whatever the cost, even if that means driving us into a recession. In 1980 when I graduated from the University of Toronto, I went to the bank to get a car loan, and did not ask what the interest rate would be. At signing time, the rate was 17.50%, I apologized to the bank officer, and let her know I would be taking the subway. This was when Paul Vockler was the chair of the Fed (brought in by Jimmy Carter), and he was brought into tame inflation, and 10 year US Treasury bonds traded at a 15% coupon. The economy went into recession.

From the June 2022 Research Affiliates article titled “No Excuses: Plan Now for Recession” the following paragraphs are worth sharing (the bold highlights are mine):

“Recessions do not naturally begin in an economy with two job openings for every job seeker. That said, there’s nothing natural about recessions. In 1998, MIT economist Rudi Dornbusch observed that “none of the post-war expansions died of natural causes, they were all murdered by the Fed.” The motive for this murder is usually to save the economy from incipient inflation by killing the economy.”

“Now is a time of heightened uncertainty, with many forces driving that uncertainty. We have an inflation rate at a four decade high. Most don't remember the last time inflation was at this level. The Fed has not had to deal with serious inflation in the past 40 years and the responses adopted now will likely slow the economy. The Fed is very late to the game because the board members were in denial for a long time. In November 2021, the Fed finally officially retired the word transitory after dismissing the inflationary pressures with that description far too long. We might be surprised that the Fed did not see this coming, but the Fed’s track record on forecasting, whether the economy or inflation, is rarely better than a Ouija board.”

Inflation is a simple consequence of a supply/demand imbalance. If demand exceeds supply, prices rise until balance is restored. The current surge in inflation has been caused mainly by blowout spending, supply chain disruptions—some related to Covid lockdowns and some to geopolitics—the Russia-Ukraine war, and working from home, which leaves people with more money to spend, even as many produce less goods and services. Which of these can the Fed influence? None? Is the Fed powerless to rein in inflation? Not at all. Central bankers can decrease demand, albeit with serious lags, even if the problem is on the supply side.

“The 40-year comparison is much talked about. Many of our current problems are self-inflicted by an extended period of negative real rates. Indeed, with robust economic growth, low unemployment, and stock markets at all-time highs, it is baffling that the Fed continued with quantitative easing and persisted in keeping short-term nominal interest rates at essentially zero. In contrast, in 1981, the fed funds rate was 19%.”

“We liken real interest rates to a speed bump. Too high and traffic is stopped: innovation, long-horizon investment in new initiatives, entrepreneurial capitalism all slow markedly. Too low and reckless driving ensues: if we are among those able to borrow at negative real rates, we will, whether we have good ideas for the money or not. Misallocation of resources and malinvestment—at the individual, corporate, and government level—naturally will follow, along with propping up zombie companies that clog the runway for the innovators. All of this in turn inhibits innovation and entrepreneurial capitalism, both because risky projects cannot access those ultra-low rates, and established enterprises and government may waste much of the free money at their disposal.”

With the above in mind we are being cautious, while I do not want a recession; we have to consider we might have one. The chart below from Merk Investments, Business Cycle Report, July 2022, clearly shows at what level traders are buying 1 year swaps (3.73%), and 1 year from now looking out another year, the price is at 3%. One of the benefits of markets is that they are clearing mechanisms; they will show the true price. Meaning, a trader does not enter into a contract unless they believe they will profit.

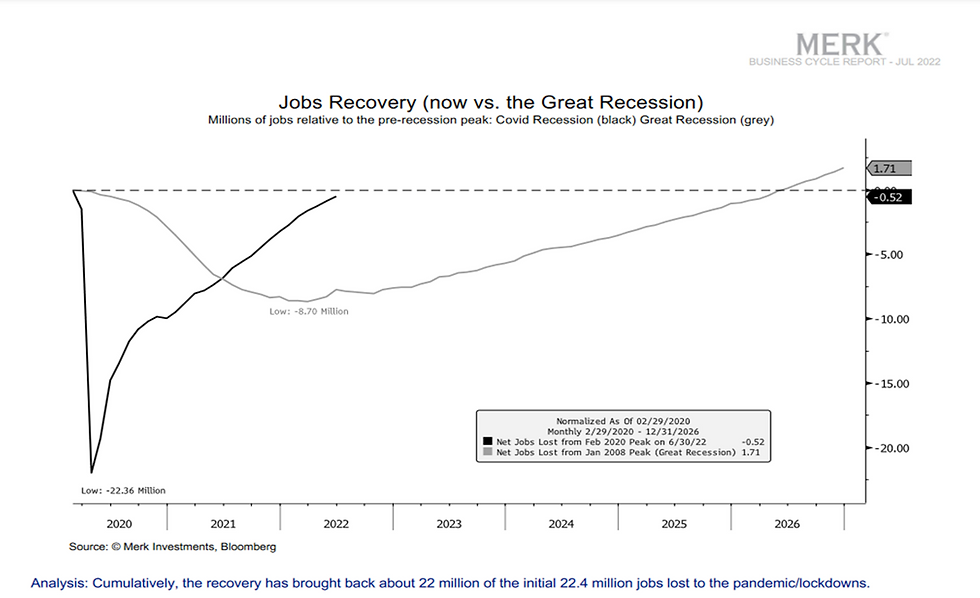

In the above chart we show that we have almost captured all of the jobs we lost during the Pandemic/Lockdown. As I have mentioned earlier it is hard to have a meaningful recession when the companies are making profits (as the 2Q/2022) is showing, we are very close to full employment, and there are 2 jobs available for every person looking for a job.

In conclusion

As we have all heard in the press, we have just had two negative quarters of GDP growth, hence are in a recession. I think not. Quite simply, there are a number of other indicators, including measure(s) of spending, income and job growth which are not close to showing a recession. We will wait until the National Bureau Economic Research (NBER) tells us we had one starting…..until then, we are not.

In summary, we will only have a recession if the FED wants one!

Finally a few Economist jokes, there is a saying for Economics, The Dismal Science:

The First Law of Economists: For every economist, there exists an equal and opposite economist. The Second Law of Economists: They're both wrong.

“We have 2 classes of forecasters: Those who don't know . . . and those who don't know they don't know. “ - John Kenneth Galbraith

President Truman once said he wants an economic adviser who is one handed. Why? Because normally the economists giving him economic advice state, "On one hand and on the other..."

If there are ever any topics you wish for us to explore, please let us know. We are here to help and guide you through these times.

We thank you all for taking the time and reading “Market Watch.” It is meant as an educational piece on the always evolving markets. It is something we plan on providing every month, and your feedback is very important to us.

On a personal note, RMH is now in the position to bring on new clients so please be sure to share this informational letter with whomever you wish. RMH’s focus is on the customizable investment needs of individuals, families, and foundations. We enjoy working with our clients to better understand their goals, values, and passions for what is important in their lives. In expanding our client base, we look forward to working with people who share these same desires.

Richard Mundinger, CFA

Ashlyn Brooke Tucker

Sources:

Economist Magazine, June 16, 2022: Cartoon KAL

Research Affiliates June 2022: No Excuses: Plan Now for Recession, Rob Arnott, Campbell Harvey

Merk Investments: The Business Cycle Report, July 2022

NY Times, Business: Is It a Recession Yet? July 26, 2022

Comentarios