RMH Thoughts for 2022

- Richard Mundinger, CFA

- Jan 28, 2022

- 9 min read

Happy 2022 to all of you, I am thinking we will have an uneventful year. As a famous line said, “sir, surely you jest”.

Well lets get started, the following topics we need to cover:

US Federal Reserve, the biggest wild card out there.

Energy and Inflation, both misunderstood

Geopolitics – a lot of noise as distraction is needed in the home countries

Cash on the sidelines , LOTS

Rotation from Growth to Value

DataTrek commentary - Markets move on earnings and macro influences

1) US Federal Reserve, the biggest wild card out there. We are already seeing talk of other countries central banks raising rates, Canada, Chile, Australia, while China is urging the world to lower rates like they have. Interesting. With this being an election year, there will be some hikes (2 – 3), however not a crushing series of hikes. I think they get the rate hikes done early in the year as they don’t want to get accused of interfering with the November elections. With that being said, the first interest rate hike will be 0.50%. Powell made mention of how strong the economy was, and mentioned wage and price inflation. The Fed is in a different position (economic strength of the U.S.) than 2016 and 2018 when they tried to raise rates. As I have mentioned several times in the past, this is the most anticipated trade in history, “when will rates rise”? Volatility and fear sow good trading desk profits.

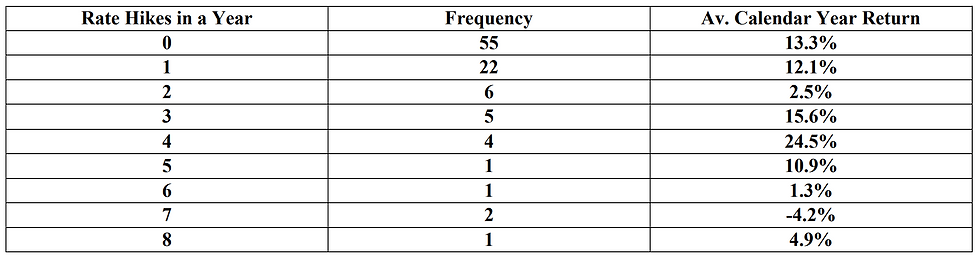

In looking at the chart below, it is not the first few rate hikes that cause problems, but the third. Let’s hope we keep the rate hikes to even numbers!

The chart from above is sourced from S&P 500 monthly total return index from 1/1/1925 – present. Fed discount rate used from 1/1/1925 – 12/31/1989. Federal Funds Target Rate used from 1/1/1990 – present.

The longer term outlook for interest rates, I believe will be slightly higher to down from where we are at this current moment in time. Quite simply the world can’t afford higher rates with all of the accumulated debt of the last several years. In addition with lower demographic growth (worldwide), there will be less demand from the private sector for loans, thereby less competition with the public sector (governments) for loan growth. Look at the interest rates in Japan, very low, with very low inflation and poor demographics of the population as they are aging significantly. On average Japan is twenty years older than the US, while China and Russia are 10 years older. To me this means less demand for loans, and lower overall growth of the economy, leading to lower interest rates.

2) Energy and Inflation (CPI). Inflation will be transitory, with an explanation the Fed did not deliver. Using Energy as an example as it is part of the CPI calculations. Roughly a year ago Energy (as calculated by the price of a barrel of oil in USD) was roughly US$40/b, today north of $80/b. For CPI calculations, Energy went up 100%. Looking out 1 year, for Energy to contribute another 100% to the CPI calculations, Energy would need to be in the $160/b. That could happen, however unlikely in my opinion. If Energy stays at a similar level as today, then the Energy contribution to CPI would be a very low contributor. This is what the Fed left out, transitory inflation, with permanent higher prices. Why didn’t they share this with us?

There has been a lack of investment worldwide in exploring for new growth in oil and natural gas production. With natural depletion of oil and natural gas fields running in the 2 – 3% range annually, then we need to find that amount each year. With oil prices being low for several years, there was very little exploration and as a result roughly 1% new growth. Combine this with the worldwide economy consuming energy now at the pre pandemic level and you have a recipe for higher prices. In addition, combine this with Europe/UK shutting down nuclear power, you have a shortage of power, especially when the sun does not shine, and the wind does not blow. Where does this power come from, France, their nuclear power grid when they can spare it? Higher prices are here to stay.

From Eoin Treacy of Fuller Treacy Money, January 24, 2022 the following:

French Nuclear Giant’s Fall Risks Energy Security for All Europe

This article from Bloomberg may be of interest to subscribers. Here is a section:

Nuclear power is dwindling elsewhere in Europe too. EDF has shut down some reactors in the U.K. earlier than planned because of other safety issues, while Germany will permanently close its three remaining reactors by the end of the year, after shutting down three others a few weeks ago. Belgium will also close a reactor in October, and halt its six others by the end of 2025.

At the same time, those countries are adding large amounts of wind and solar generation, filling the gap left by nuclear but increasing their energy systems’ dependence on the whims of the weather. Without reliable baseload power exports from EDF, a cold and windless winter day will become a potentially stressful scenario. “The dependency on France is likely to increase with Germany getting out of coal and nuclear,” said Johannes Pretel, head origination for Germany at Swiss utility Axpo Holding AG. “This winter we still had all of our capacity, next winter we don’t have it anymore because the last nuclear plants will be out.”

(Eoin Treacy) My view - Europe stopped building reactors thirty years ago. Today there is little appetite to invest in the infrastructure required to maintain aging plants or to build new ones. The loss of the primary source of base load electricity is going to be felt across the continent for years to come. Even if they decided to spend the money today, it would still be a decade before new reactors come into service.

One of the subscription services we use is the LeadLag report written by Michael A. Gayed, CFA. The following chart shows to me we are in the early stages of the energy rally, a sector that has been out of favor due to low prices, and the concern with global warming. Quite simply, we cannot get to a “green” future without the current energy complex!

Energy (XLE) – Potentially Still Early In The Rally

Higher energy prices and the anticipation of global demand once the omicron variant subsides has kept a steady net of support under energy stocks. While many investors who haven’t bought assume they’ve “missed out” on recent gains, it’s important to remember that if you pull back your view on the sector, the rally could still be in its very early stages.

3) Geopolitics – a lot of noise as distraction is needed in the home countries.

Russia will not have a meaningful war in the Ukraine. Simply put, 6 years ago they could have rolled through the Ukraine in a month. Now they have to fight if they want the country. The body bag count would be too high, and this is not important back home to the citizens. Instead they are using this as an excuse to rattle the EU and the US, to cover up their internal issues. It will be a guerilla war if it occurs.

China, same as Russia, using Taiwan as a way to keep the attention off the problems at home, and rattle the US and the Western world. The leaders in China have one pressing issue, keep 1.2B people happy, hard to do when you are short of energy and water as a nation, and you keep building cities where you have arable land, a demographic problem of their own making (shrinking population), and a real estate collapse. -

Weak US leadership creates a vacuum.

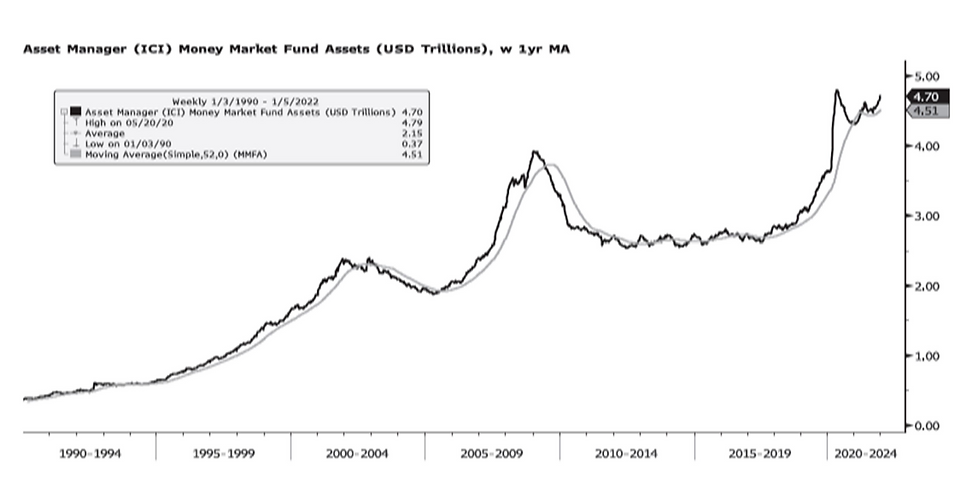

4) Cash on the sidelines , LOTS.

There is over $4.5T in asset manager cash, and $2.5T cash on corporate balance sheets. The following chart is one of my favorites, easy to read and come to a conclusion. There is a lot of cash. It is hard to have a meaningful correction with all of this cash sitting on the sidelines.

5) A rotation of growth to value. How robust, only time will tell.

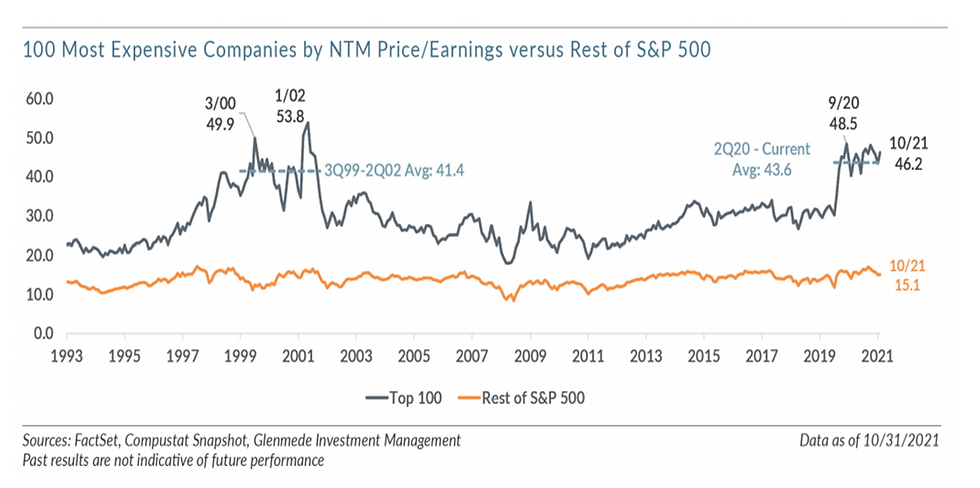

The following is from Glenmeade Investment Management:

The most expensive names based on forward price/earnings (NTM P/E) in the S&P 500 are trading at near-record valuations. As seen in the chart, the forward P/E for the 100 most expensive names in the index is 46.2, which is in the 97th percentile since 1993 and well above the long-term average of 29.7. Meanwhile, the other 400 names in the index have a forward P/E of 15.1, which is only a slight premium to their long-term average of 13.8 and in the 77th percentile since 1993.

Put quite simply, the last 6 months of last year saw a huge inflow into the Large Cap Growth names for safety. This in turn forced the cap weighted S&P 500 and NASDAQ, up. In addition all of the various Environmental Social Governance (ESG) managers were investing in the same securities. These pressures forced the price up of the following securities Apple, Google (Alphabet), Amazon, Netflix, Nvidia, Facebook, Microsoft, Tesla to name a few of the Large Cap Growth stocks. A bubble was in the making, now we are seeing this undone in the rotation to value (dividend paying stocks).

From the Lead-Lag report: Dividend Stocks (SDY) – Best Action In A Year

The above chart comes from the Lead-Lag Report and “shows the relative strength in cyclicals and defensive stocks keeps this ratio moving higher in a way we haven’t seen in about a year. As long as growth and small-caps remain out of favor and the maturing economic cycle narrative is intact, there’s a strong case to be made that dividend stocks can outperform further here.”

6) DataTrek commentary: Markets move on earnings and macro influences.

From the January 19th, 2022 morning briefing of Data Trek the following:

Yes, US large cap companies should continue to return most of their net operating income to shareholders. Recall that net operating income already includes R&D expenses, depreciation and amortization, personnel expenses and everything else needed to grow a business. GAAP net income may not perfectly align with free cash flow because of incremental CapEx, true. But the US/global economy of the 21st century relies far more on hiring the right people and managing them correctly than on physical asset efficiency or expansion.

Since we are facing at least 1-3 years of economic uncertainty because of Federal Reserve policies to counter inflation, dividend growth will do more to enhance shareholder value than incremental stock repurchases. Corporate dividend policy is a signal to investors about management’s medium-run view of their company’s earnings power. Buybacks offer much less information to markets; they can be cancelled or altered at any time.

In a rising rate environment, companies that choose to increase their dividends more than their peers in the same industry should have a relative performance edge. This is because of the prior point: raising a payout by 10 percent when your competitors are only increasing their dividends by 5 percent reflects incremental management confidence in the future.

Shifting the conversation back to what all this means for investors, we are raising this issue because the S&P 500 as a whole still has very strong incremental free cash flow that remains unallocated. In the first 3 quarters of 2021, for example, 23 percent of S&P operating earnings went neither to dividends nor buybacks. That is much higher than pre-pandemic 2018 – 2019’s 3-7 percent.

On top of that, the allocation of cash flow between dividends and buybacks in 2021 was heavily skewed to the later versus the former when compared to pre-pandemic 2019:

The companies of the S&P 500 paid $130.0 bn in dividends in Q3 2021, only 7 percent more than the average quarterly payout in 2019 ($121.4 bn).

S&P 500 companies bought back $410.5 bn in stock in Q3 2021, 29 percent more than the average quarterly repurchase run rate in 2019 ($182.2 bn).

The S&P 500 is roughly 50 percent higher than it was in 2019. Since so much incremental corporate profit has gone to buybacks at the expense of dividends, the index’s yield today is just 1.3 percent. It was 1.8 percent in December 2019.

Takeaway: public companies need to rethink their dividend policies and investors should put more weight on this under-appreciated facet of corporation finance decision-making. Even with recent market volatility, no one seriously doubts corporate profits will remain robust over the next several years. Where that money goes – dividends or buybacks – will tell markets which management teams truly understand what drives their stock prices.

If there are ever any topics you wish for us to explore, please let us know. We are here to help and guide you through these times.

We thank you all for taking the time and reading “Market Watch.” It is meant as an educational piece on the always evolving markets. It is something we plan on providing every month, and your feedback is very important to us.

On a personal note, RMH is now in the position to bring on new clients so please be sure to share this informational letter with whomever you wish. RMH’s focus is on the customizable investment needs of individuals, families, and foundations. We enjoy working with our clients to better understand their goals, values, and passions for what is important in their lives. In expanding our client base, we look forward to working with people who share these same desires.

Richard Mundinger, CFA

Sources:

DataTrek: January 13, 2022

Joachim Klement: About That Energy Inflation, January 12, 2022

Joachim Klement: https://klementoninvesting.substack.com/p/invert-always-invert-energy-crisis; October 19, 2021

Glenmeade Investment Management :The Rich Get Richer – Top P/E Names Near Historic Levels 11/15/2021

Fuller Treacy Money January 24, 2022 https://www.leadlagreport.com/articles/january-25-2022-leaderslaggards

Economist: January 15, 2022

Data Trek: January 19, 2022

コメント